5 Best Gold Stocks to Buy Today

| Company (Ticker) | 12 Week Price Change | Forward PE | Price | Proj EPS Growth (1 Year) | Projected Sales Growth (1Y) |

|---|---|---|---|---|---|

| Kinross Gold (KGC) | 41.30% | 14.66 | $33.29 | 35.23% | 11.03% |

| Agnico Eagle Mines (AEM) | 20.66% | 20.46 | $197.28 | 22.78% | 11.34% |

| Royal Gold (RGLD) | 38.46% | 24.05 | $254.19 | 31.55% | NA |

| Centerra Gold (CGAU) | 44.70% | 12.47 | $15.96 | 30.08% | NA |

| Allied Gold Corporation (AAUC) | 54.80% | 4.82 | $27.26 | 308.44% | 45.35% |

*Updated on January 15, 2026.

Kinross Gold (KGC)

$33.29 USD -0.08 (-0.24%)

3-Year Stock Price Performance

Premium Research for KGC

- Zacks Rank

- Strong Buy 1

- Style Scores

C Value A Growth F Momentum B VGM

- Market Cap:$36.76 B (Large Cap)

- Projected EPS Growth: 147.06%

- Last Quarter EPS Growth: 0.00%

- Last EPS Surprise:12.82%

- Next EPS Report date:Feb. 11, 2026

Our Take:

Kinross Gold is a senior producer with core mines in the Americas and West Africa, providing direct leverage to bullion and a growth pipeline led by Great Bear in Ontario. Recent performance has improved alongside higher realized prices and disciplined costs.

In the last reported quarter, Kinross delivered record free cash flow as margins expanded faster than gold prices. It ended the period in a net-cash position and increased capital returns, underscoring balance-sheet flexibility to fund projects while rewarding shareholders. Portfolio execution at Paracatu, Tasiast and La Coipa remained on track.

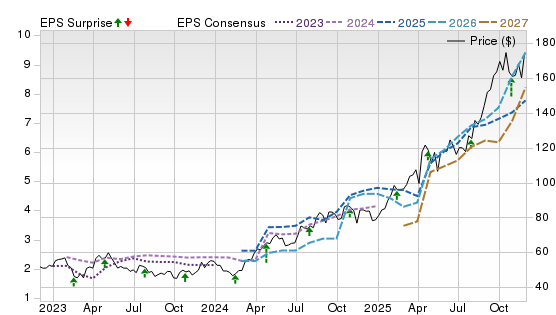

A Zacks Rank #1 (Strong Buy) signals positive earnings revisions, and Style Scores of A for Growth and C for Value and Momentum, suggest improving profitability is the main driver, even as near-term trading remains choppy. On KGC’s Price, Consensus & EPS Surprise chart, shares have broken to new highs while 2026–2027 EPS lines step higher.

Agnico Eagle Mines (AEM)

$197.28 USD -1.80 (-0.90%)

3-Year Stock Price Performance

Premium Research for AEM

- Zacks Rank

- Strong Buy 1

- Style Scores

D Value B Growth F Momentum C VGM

- Market Cap:$91.35 B (Large Cap)

- Projected EPS Growth:86.05%

- Last Quarter EPS Growth: 11.34%

- Last EPS Surprise:22.73%

- Next EPS Report date: Feb. 12, 2026

Our Take:

Agnico Eagle is a low-risk gold producer concentrated in Canada and Finland, with cornerstone assets such as Detour Lake and the Canadian Malartic complex anchoring long-life exposure to gold. Its last reported quarter showed record adjusted net income, strong free cash flow generation and continued debt reduction, while production remained steady.

The company is simultaneously advancing multi-year growth projects, while maintaining dividends and buybacks, which are hallmarks of disciplined capital allocation. Total capex for 2025 is likely to be within the $1.75-$1.95 billion range.

A Zacks Rank #1 reflects upward estimate revisions. Style Scores of B for Growth offset a D for Value and F for Momentum, pointing to fundamentals, not technicals, driving the call. On AEM’s chart, price is in a persistent uptrend with consensus EPS for 2026–2027 trending higher and tightly clustered, a constructive setup that supports sustained rerating as Odyssey ramps and Detour optimization advances.

Royal Gold (RGLD)

$254.19 USD +0.21 (0.08%)

3-Year Stock Price Performance

Premium Research for RGLD

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

F Value C Growth F Momentum F VGM

- Market Cap:$20.49 B (Large Cap)

- Projected EPS Growth:52.85%

- Last Quarter EPS Growth:13.81%

- Last EPS Surprise:-10.43%

- Next EPS Report date:Feb. 11, 2026

Our Take:

Royal Gold is a precious-metals royalty and streaming company, offering gold-centric exposure with minimal operating and capital cost risk across a diversified portfolio. In the last reported quarter, it announced record revenues, driven by higher average metal prices, gold sales from Andacollo and Rainy River and increased production from Peñasquito.

New contributions from Côté Gold, Mara Rosa and Manh Choh, plus incremental portfolio additions and a support agreement tied to Mount Milligan, broaden near-term cash-flow drivers.

A Zacks Rank #1 underscores positive revisions even as Style Scores skew lower with D for Value and Growth and F for Momentum, a profile typical for premium royalty models that trade above miners on quality and predictability. On the chart, shares have recovered toward highs while the 2026–2027 EPS lines stair-step upward, suggesting analysts see royalty volumes and realized pricing compounding through the cycle without the margin drag of mine-site inflation.

Centerra Gold (CGAU)

$15.96 USD -0.11 (-0.68%)

3-Year Stock Price Performance

Premium Research for CGAU

- Zacks Rank

Strong Buy 1

Strong Buy 1

- Style Scores

B Value B Growth B Momentum A VGM

- Market Cap:$3.12 B (Mid Cap)

- Projected EPS Growth:39.44%

- Last Quarter EPS Growth:32.00%

- Last EPS Surprise:50.00%

- Next EPS Report date:Feb. 19, 2026

Our Take:

Centerra Gold is a gold-copper producer led by Mount Milligan in Canada and Öksüt in Türkiye, offering leverage to gold with copper by-product support. The last reported quarter showed solid free cash flow, healthy margins and supportive metal prices. It ended the quarter with $561.8 million in cash and $961.8 million in total liquidity, strengthening balance-sheet flexibility.

Key catalysts include mine-life extension and productivity upgrades at Mount Milligan, with studies pointing to longer reserves. A renewed buyback program and steady dividend highlight disciplined capital returns.

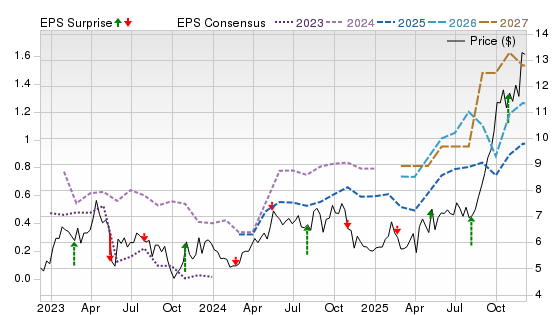

A Zacks Rank #3 (Hold) with Style Scores of A for Value, Growth and Momentum indicates attractive valuation at current levels, improving growth and momentum, but with more balanced near-term expectations. On CGAU’s chart, the stock has surged to new highs as 2026–2027 EPS estimates lift, reflecting confidence in steadier output at Öksüt, albeit with some estimate variability typical for a two-asset profile.

Allied Gold Corporation (AAUC)

$27.26 USD +0.70 (2.64%)

3-Year Stock Price Performance

Premium Research for AAUC

- Zacks Rank

Hold 3

Hold 3

- Style Scores

B Value A Growth C Momentum A VGM

- Market Cap:$3.08 (Mid Cap)

- Projected EPS Growth:885.71%

- Last Quarter EPS Growth:107.14%

- Last EPS Surprise:-38.30%

- Next EPS Report date:March, 30, 2026

Our Take:

Allied Gold is an Africa-focused gold producer operating Sadiola in Mali and the Côte d’Ivoire complex (Agbaou and Bonikro), giving investors emerging-market leverage to bullion with multiple optimization levers. The last reported quarter revealed production of 87,020 oz with meaningful cost improvements.

Management has highlighted further operational improvements and potential expansions at Sadiola, alongside steps to strengthen financial flexibility, key to funding growth while navigating regional risks. Ore processing at Sadiola’s Phase 1 expansion came online in December 2025.

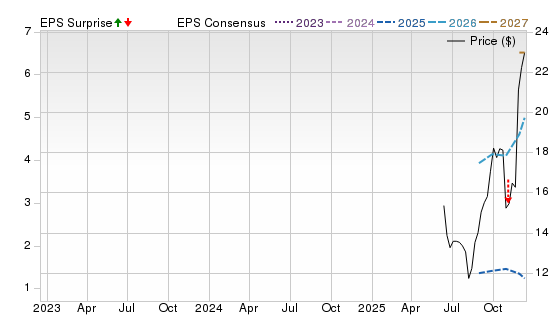

A Zacks Rank #3 with Style Scores of A for Growth and Momentum and B for Value suggests estimates are stabilizing and momentum tied to operational execution is building, though valuation still embeds some risk premium. On AAUC’s chart, limited trading history shows sharp price swings, but forward EPS lines for 2026–2027 trend higher, consistent with production gains and optimization plans across the portfolio.

Methodology

The Zacks Rank is a proprietary stock-rating model that uses trends in earnings estimate revisions and earnings-per-share (EPS) surprises to classify stocks into five groups: #1 (Strong Buy), #2 (Buy), #3 (Hold), #4 (Sell) and #5 (Strong Sell). The Zacks Rank is calculated through four primary factors related to earnings estimates: analysts' consensus on earnings estimate revisions, the magnitude of revision change, the upside potential and estimate surprise (or the degree in which earnings per share deviated from the previous quarter).

Zacks builds the data from 3,000 analysts at over 150 different brokerage firms. The average yearly gain for Zacks Rank #1 (Strong Buy) stocks is +23.62% per year from January, 1988, through June 2, 2025.

Selections for Best Gold Stocks are based on the current top ranking stocks based on Zacks Indicator Score. For this list, only companies that have average daily trading volumes of 100,000 shares or more were considered. All information is current as of market open, Jan. 8, 2026.

Guide to Gold Stocks

Is it a good time to invest in gold stocks right now?

Given that gold prices are already elevated and many forecasts point to further upside, now is considered a “reasonable time” by many analysts to consider gold stocks. The leverage effect of mining companies means they may outperform bullion if gold continues to rise.

However, one must also be cautious: valuations for some stocks might already reflect part of the rally, and risks remain (see next). It’s prudent to size positions carefully and maintain diversification.

Benefits of investing in gold stocks

- Operational leverage: As gold prices climb, miners’ margins expand because cost per ounce is relatively fixed.

- Dividend potential: Some mature gold companies pay dividends or buy back shares, offering a yield component beyond price appreciation.

- Portfolio diversification: Gold stocks can reduce correlation with typical growth stocks, providing a hedge in volatile markets.

Risks of investing in gold stocks

- Operational & geological risk: Mining has many moving parts—cost overruns, mine disruptions, regulatory issues, jurisdiction risks.

- Gold-price risk: If gold falls or stagnates (for example due to higher interest rates), miners will suffer in the opposite direction—sometimes more steeply.

- Valuation risk: Stocks may already price in strong future gold prices; if those don’t materialize, downside exists.

Gold stocks vs Gold stocks ETF vs physical Gold

- Physical Gold: You own actual bullion; no company risk, but you incur storage & insurance costs, no dividends, and liquidity might be lower.

- Gold stocks: You get corporate leverage to gold price, potential dividends, but you assume company-specific risks.

- Gold ETFs (physical bullion): Track gold price directly, low cost, easy to trade, no storage issues—but they don’t offer dividends or operations upside.

- Gold-mining ETFs: Bundle many gold stocks—diversifies company risk but still carries mining equity risk—and may amplify upside or downside relative to bullion.

How to Select the Best Gold Stocks

When evaluating individual gold names:

- Check cost per ounce (all-in sustaining cost) and production profile.

- Verify debt levels and balance-sheet health.

- Look for a diversified asset base (geography, mine life).

- Dividend or buyback policy.

- Management track-record and governance.

- Valuation relative to peers and forward earnings.

Gold stocks vs Silver stocks: Which one is better?

Silver stocks offer exposure to both precious-metal demand and industrial applications (solar panels, EVs, electronics), which creates a different demand profile. That said, silver often underperforms gold during safe-haven rushes and may carry extra cyclicality. For investors focused purely on a hedge or safe-haven, gold stocks are often the preferred choice—but mixing both may enhance diversification.

Market Trend and Forecast about Gold Stocks

What factors are driving gold prices?

Key drivers include:

- Central-bank buying of gold as part of reserves diversification.

- A weak U.S. dollar and lower real interest rates make gold more attractive (because gold yields no interest).

- Geopolitical uncertainty and inflation concerns push investors toward safe-haven assets.

- For miners: higher gold price, stable or declining costs per ounce, improved cash flows.

How do gold stocks perform during inflation or recession?

Historically, gold and gold-stocks have had better relative performance during periods of high inflation or economic stress—thanks to their hedge status. In recessions, while equities may falter, gold may hold its value or rise, which can support gold stocks. That said, mining companies may face production or cost pressures during downturns, so while the metal may hold up, company risks still exist.

Are gold mining stocks undervalued right now?

According to some research, yes. For example, one note points out that while gold has rallied significantly, many mining companies’ valuations remain conservative relative to the metal’s price — offering potential upside if the rally continues.

Still, because many investors have already rotated into the sector, valuations may be less of a bargain than in past cycles.

Will rising Interest rates hurt gold mining companies?

Rising real (inflation-adjusted) interest rates typically increase the opportunity cost of holding non-yielding assets like gold, which can weigh on gold prices—and thus miners. Additionally, higher rates increase costs for mining firms that borrow. On the flip side, if higher rates reflect inflation-risk or weakness in the economy, gold may benefit. So the net impact depends on the underlying cause of rate increases.

Gold ETFs and Alternatives

Are gold ETFs better than individual gold stocks?

If your primary goal is to track the price of gold (for example as a hedge) rather than pick specific companies, ETFs that hold physical gold may be a simpler, lower-risk approach. They eliminate much of the company-specific risk inherent in mining stocks. On the other hand, stock exposure offers the possibility of outsized returns (when gold rises) via operational leverage—but also greater downside.

Should I invest in gold mutual funds or ETFs? Where is the difference?

- Gold ETFs typically offer direct exposure, low expense ratios, high liquidity, and transparent holdings.

- Gold mutual funds may invest in a mix of gold stocks, sometimes along with other precious-metal companies, and may have higher fees or minimums. For many self-directed investors, ETFs are more efficient.

Which is appropriate depends on your tax situation, jurisdiction, and preferred investment vehicle.

Should I invest in gold for diversification or growth?

Gold is most commonly used as a diversifier—to reduce portfolio risk, hedge inflation, or provide safe-haven exposure. If you’re seeking growth, gold stocks (especially mining companies) may offer upside—but with higher risk. Understand the role you want gold to play in your portfolio before choosing.

How do dividends from gold companies compare to other sectors?

Many gold mining companies may pay dividends or buy back shares, but yields generally tend to be lower than high-dividend sectors such as utilities or REITs. Because their cash-flows are heavily dependent on commodity prices, dividends may be more variable and less predictable. Royalty/streaming companies often offer steadier payouts.

Best way to diversify with silver in a portfolio

Silver provides a related yet distinct exposure: it is both a precious metal and an industrial metal. To diversify with silver: consider silver-mining stocks or silver ETFs; assess how it correlates with gold and your broader portfolio; keep allocation moderate since silver can be more volatile. Pairing gold and silver may add another dimension of diversification.

Should I invest $1,000 Right now in Gold Stocks and What Will It Look Like?

If you invest $1,000 today in a basket of gold stocks or a gold-stock oriented ETF, here’s a simplified illustration:

- Suppose gold rises by 20% over the next year and miners, benefiting from operational leverage, rise by 30%.

- A $1,000 investment grows to $1,300 (assuming no fees/dividends).

- If instead gold stagnates or falls 10%, miners might fall 15-20% due to the leveraged effect, and you’d end up around $800-$850.

This underlines both the opportunity and risk. A prudent approach: allocate only a portion of your portfolio (e.g., 5-10%) to gold stocks, have a longer time horizon (3-5 years or more), and monitor costs, valuations, the macro backdrop, and company fundamentals.

Common Questions About Gold Stocks

Do gold stocks pay dividends?

Yes—many established gold companies (especially large-caps or royalty/streaming firms) distribute dividends or execute buy-backs. However, payout levels depend on production, gold price, costs, and company capital allocation decisions.

What stocks are backed by gold?

While no stock is “backed” by gold in the same way that a bullion bar is backed, many mining companies’ profitability is tied directly to the gold price. Royalty or streaming companies may also offer quasi-“gold exposure” via agreements to buy gold production at fixed prices.

Is Warren Buffett buying gold?

Historically, Buffett has expressed skepticism toward gold as a productive investment and has favoured businesses generating cash flow rather than commodities per se. There’s no major reported shift recently indicating he’s investing heavily in gold or gold stocks. (As always, check the latest filings for updates.)